Great Mortgages. The Right Insurance. Expert Advice.

Rate Trends: Bank vs. Mono-line Lenders

Your Outline Financial Team.

Call or email at any time:

In response to numerous questions we’ve received about the direction of rates recently, we’ve included an overview of what we believe is happening in the current rate environment and where we are headed.

Current Bank versus Mono-line Lender Rates = Client Opportunity?

While there is never a “right” answer for an economic opinion, one thing is for certain, the major bank mortgage rates have drifted upward over the past number of months resulting in them being significantly higher than what is currently available through mono-line lenders.

While time will tell if mono-line rates follow a similar path, for the immediate term, there may be significant savings available to any client that has or is planning to purchase and will be closing within the next 30 to 90 days.

What has created this interest rate variance?

While others may offer a different opinion, based on our review of the market, we believe the following to hold true:

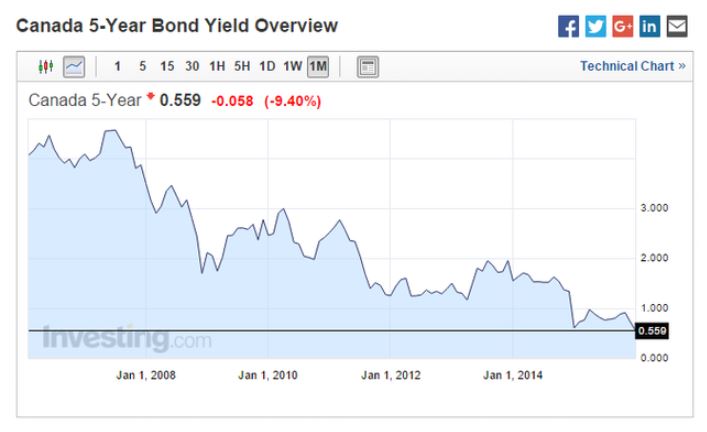

- 5 year Bank of Canada bond yields have been dropping like a rock. As of today (Jan 15, 2016), the current yield is 0.559% which is by far the lowest range in history (we’ve included a graph of the bond yield history at the bottom of this email).

- 5 year mortgage rates almost always move in a direct relation to the 5 year Bank of Canada Bond Yield.

- Current Rates – while we are seeing this drop reflected in the mono-line lender world (5yr fixed rates in the 2.5%’s to 2.7%’s range are now available), the banks seem to be going in the opposite direction (they have increased their discounted 5yr fixed rates to the 2.8%’s to 3.0%’s range)*.

- Why are bank rates going up? – the general consensus is that the cost of borrowing for banks has increased. Given an expected change in capital requirement by OSFI, along with a market perception that the banks may be in for a tough ride given the economy, investors are requiring a higher return on their money (i.e., banks’ borrowing costs increased).

- Will bank rates continue to rise? – In our opinion, if the bond market stays where it is (which is likely), the banks won’t be able to go much higher. We believe the banks have already increased their rates by a sufficient margin to hedge against their risks, and may pull back as we approach the spring market.

- Should current variable rate clients lock into a fixed rate? While a lot depends on personal preference/risk tolerance, given where the bond yields are, we believe if someone has an existing Variable Rate Mortgage (VRM) at Prime -50bps or better (i.e., 2.2% or lower), we would stay the course and reap the benefits as we don’t anticipate the Prime rate heading up anytime soon – in fact, economists are actually talking about a reduction in the overnight rate which could translate to a further reduction in Prime (assuming bank pass along the savings). Where our opinion may differ is with respect to new mortgages. Given lenders have tightened their VRM formulas recently (due to an increased cost in the short term market), new clients are now looking at variable rate offers as high as 2.6% at many major banks (still 2.2% to 2.3% at most mono-lines). Given the rate gap between fixed and variable is relatively small, new buyers will have to consider how much risk they are prepared to take.

While the rate environment is constantly changing, we hope the above is helpful/timely, and we are happy to discuss in more detail at any time.

* As always, the above rates are meant for illustrative purposes only, subject to qualifying conditions, and could change at any time without notice. Please provide our contact information should a client want to discuss their specific situation.