The Outline

The Bank of Canada maintained its policy interest rate at 2.75% for a second consecutive meeting

Business, Economy, Interest Rate Update, News https://www.outline.ca/wp-content/uploads/2025/06/Breaking_News_x_Did_you_know-copy.jpg

828

1069

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2025-04-16 17:53:422025-06-04 18:54:14Bank of Canada Holds: Why and What’s Next

https://www.outline.ca/wp-content/uploads/2025/06/Breaking_News_x_Did_you_know-copy.jpg

828

1069

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2025-04-16 17:53:422025-06-04 18:54:14Bank of Canada Holds: Why and What’s Next

Seven in a row! The Bank of Canada announces another 0.25% reduction. What could this mean for you?

Business, Economy, Interest Rate Update, News

Fixed vs. Variable Mortgage Rates: How the U.S.-Canada Trade War Could Reshape the Housing Market

Business, Economy, News, Real Estate Market

Six in a row! The Bank of Canada announces another 0.25% reduction. What could this mean for you?

Business, Economy, Interest Rate Update, News

A Flury of Beneficial Mortgage Rule Changes Heading into 2025!

Business, Economy, Interest Rate Update, News

Five in a row! The Bank of Canada announces a jumbo 0.50% reduction. What could this mean for you?

Business, Economy, Interest Rate Update, News https://www.outline.ca/wp-content/uploads/2024/12/calendarrr.png

468

584

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

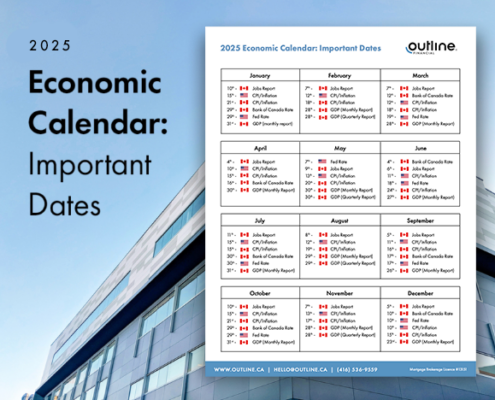

Jason Lang2024-12-17 16:56:582025-01-24 19:27:082025 Economic Calendar: Important Dates

https://www.outline.ca/wp-content/uploads/2024/12/calendarrr.png

468

584

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2024-12-17 16:56:582025-01-24 19:27:082025 Economic Calendar: Important Dates

Four in a row! The Bank of Canada announces a jumbo 0.50% reduction. What could this mean for you?

Business, Economy, Interest Rate Update, News

Insured Purchase Cap Increase and 30 Year Amortizations

Business, Economy, Interest Rate Update, News

Three in a row! The Bank of Canada announces another 0.25% reduction. What could this mean for you?

Business, Economy, Interest Rate Update, News