Great Mortgages. The Right Insurance. Expert Advice.

Bank of Canada Increases Overnight Rate – What does this mean for you?

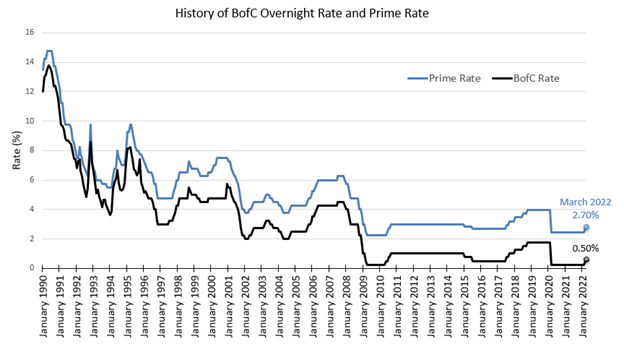

Today, as widely expected, the Bank of Canada increased their overnight rate by 0.25%. Lenders are expected to follow later this week increasing their Prime Lending Rates accordingly – Prime Rate increasing from 2.45% to 2.70% (TD Mortgage Prime would move from 2.60% to 2.85%).

Why did the Bank of Canada (BofC) increase their overnight rate?

In its statement accompanying the decision, the Bank said: “As the economy continues to expand and inflation pressures remain elevated, the Governing Council expects interest rates will need to rise further.”

Last year’s stronger-than-expected GDP reading of 6.7% “confirms [the BofC’s] view that economic slack has been absorbed.”

That being said, the Bank of Canada also recognized areas of global uncertainty that they will be following closely: the “invasion of Ukraine by Russia is a major new source of uncertainty”, “financial market volatility has increased”, “the possibility of new [COVID] variants remains a concern”.

This is the Bank of Canada’s first-rate hike since October 2018, and it is widely anticipated the market will see additional rate hikes this year.

To access the Bank of Canada’s statement please click here.

What does this mean for you?

Scenario 1: You have a variable “non-adjustable” mortgage (VRM)

In this scenario your mortgage payment will remain the same, however, a higher proportion of each payment will go towards paying interest vs. principal. The net impact is an extended amortization (total amount of time to pay off your mortgage will be longer).

What can you do? As variable rates remain well below fixed rates, you could keep everything the same and continue with the same monthly payment. Alternatively, you could increase your mortgage payment to ensure you remain on pace with your current amortization schedule. For questions on your payment strategy, or to review potential pros/cons of converting your current VRM into a fixed mortgage, please reach out at any time.

Scenario 2: You have a variable “adjustable” mortgage (ARM).

In this scenario, your mortgage payment will automatically increase to ensure you keep pace with your current amortization schedule. If you would like to discuss future interest rate projections, or the potential pros/cons of converting your ARM into a fixed mortgage, please reach out at any time.

Scenario 3: You have a fixed-rate mortgage.

If you have a fixed-rate mortgage, there is no impact on your mortgage payment (or amortization) as you have received a guaranteed rate for the duration of your mortgage term. Only when your mortgage comes up for renewal, or if you sold and purchased a new home, would you potentially be impacted by higher rates.

Scenario 4: You are currently looking for a mortgage or pre-approval.

To be fixed or variable…that is the question! While we could write a novel on this one topic, there are a couple of key points that you will want to keep in mind if trying to decide between the two.

– Variable rate mortgages are directly impacted by the Bank of Canada as described in Scenario 1 and 2 above and will move up or down based on the BofC rate decisions. Variable rate mortgages are much more flexible than fixed rate mortgages in terms of exit penalties if you ever need to break your mortgage.

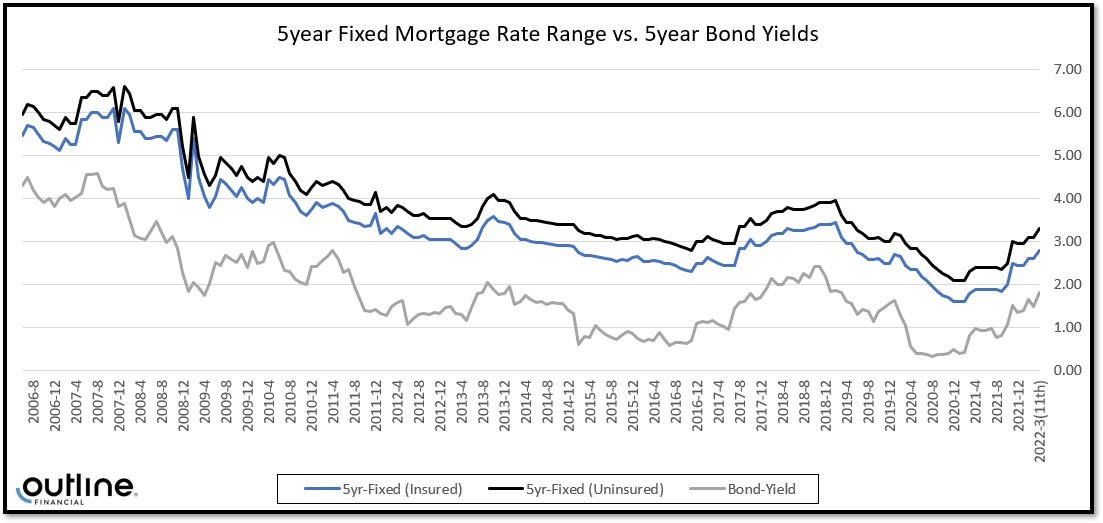

– 5-year fixed mortgage rates typically follow the Government of Canada 5-year Bond Yields which is the market’s view/prediction of where interest rates will be in the future. The bond yields actually started moving upward back in very early 2021 in anticipation of a future Bank of Canada rate increase(s) in 2022 and beyond. We’ve included a chart below that compares historical 5yr Canada Bond Yields to approximate 5yr Fixed mortgage rates.

– “Mind the Gap ” – when deciding between fixed and variable it is important to analyze not only the difference in the current rates, but also the expectation of future Bank of Canada rate changes. For example, if you are choosing between a fixed rate of 2.95% (a sure thing for the term of your mortgage) and a variable rate option of 1.45% (subject to change over the term of your mortgage), will the 1.5% “GAP” or “initial rate savings” be sufficient to protect you from any future Bank of Canada rate increases? Every situation is unique and we have a number of tools that can help model out the expectations for your specific circumstances.

For a customized analysis of which rate or product option might be right for you, please contact a member of the Outline Team as we are always on standby to help.

w: www.outline.ca

e: hello@outline.ca