Great Mortgages. The Right Insurance. Expert Advice.

Is Today the Right Time to Buy?

We’ve all read the headlines about house prices falling and interest rates rising but what does that mean to you as a potential home buyer? Is now the time to get in the market? Where does the impact of these higher interest rates leave you?

According to Toronto Regional Real Estate Board (TRREB), between February and September 2022, the average price of a detached home across the GTA fell by approximately 24%*.

In February 2022, the average detached home price was approximately $1,797,203 and by September the average price dropped to $1,369,186.

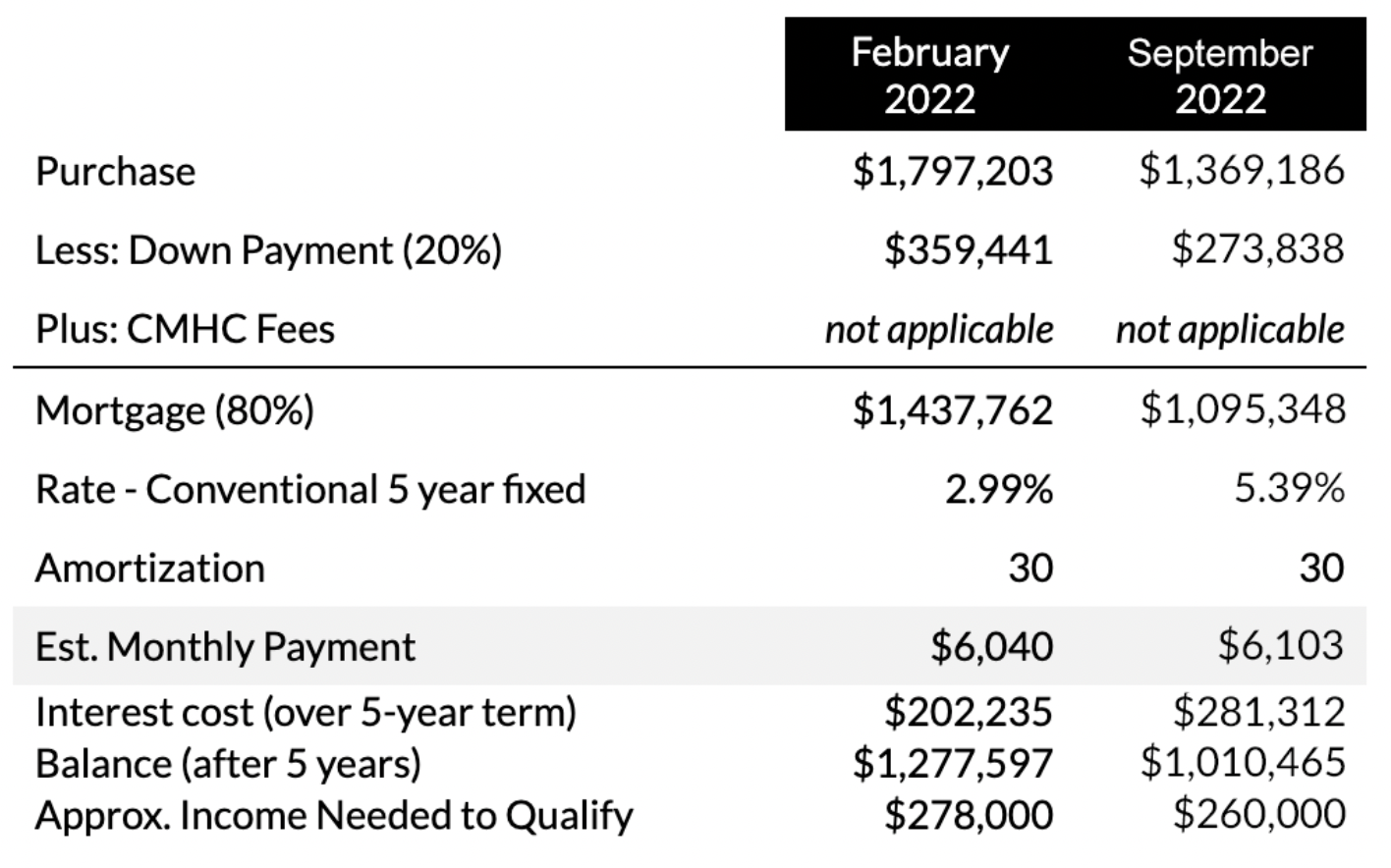

Let’s break this down from a dollars and cents perspective assuming a 5-year fixed mortgage rate and 30-year amortization. The below is for illustration purposes only.

Conventional Financing Based on Average Price of Detached Home in GTA (TRREB DATA)

On February 1st, conventional 5-year fixed rates were in the range of 2.99% and as of October 1st we are closer to 5.39% range, a difference of 2.40%.**

How do mortgage carrying costs compare given the rise in interest rates?

As illustrated in the above chart, the monthly mortgage payment remains relatively similar ($6,040 vs. $6,103) when comparing the February to September figures.

However, the September purchase requires less down payment ($273.8K vs. $359K) and has a smaller mortgage balance at the end of the 5-year term ($1,010,466 vs. $1,277,597).

How have these higher interest rates impacted your borrowing power?

Based on the average price of a detached home in February (with 80% financed through a mortgage of $1,437,762) a buyer needed an approximate household income of $278,000 to qualify. The same buyer looking to purchase an average price detached home in September (with 80% financed through a mortgage of $1,095,348) would need a household income of approximately $260,000 to qualify.

Although higher interest rates have reduced one’s borrowing power, buyers don’t actually need to borrow as much money given the accompanying reduction in average home prices as outlined in our above example.

*According to TRREB, the average price for detached home across the GTA fell from $1,797,203 in February 2022 to $1,369,186 in September 2022 (a reduction of -23.8%). Speak to your Realtor about average price changes for any TRREB neighbourhood or property type as figures can vary significantly.

*TRREB’s Home Price Index (HPI) for single family detached homes also reported a decline over the period falling from 440.4 in February 2022 to 357.5 in September 2022 (a reduction of -17.9%). Speak to your Realtor for more information.

**Interest rates are for illustrative purposes only and subject to change (up/down) at any time. Significantly lower rates are available for insured mortgages (<$1M purchase and <20% down payment), and conventional rate specials are also available. Speak to your Outline Financial mortgage agent to learn more.