Great Mortgages. The Right Insurance. Expert Advice.

Bank of Canada Increases Overnight Rate by Another 0.50% – What does this mean for you?

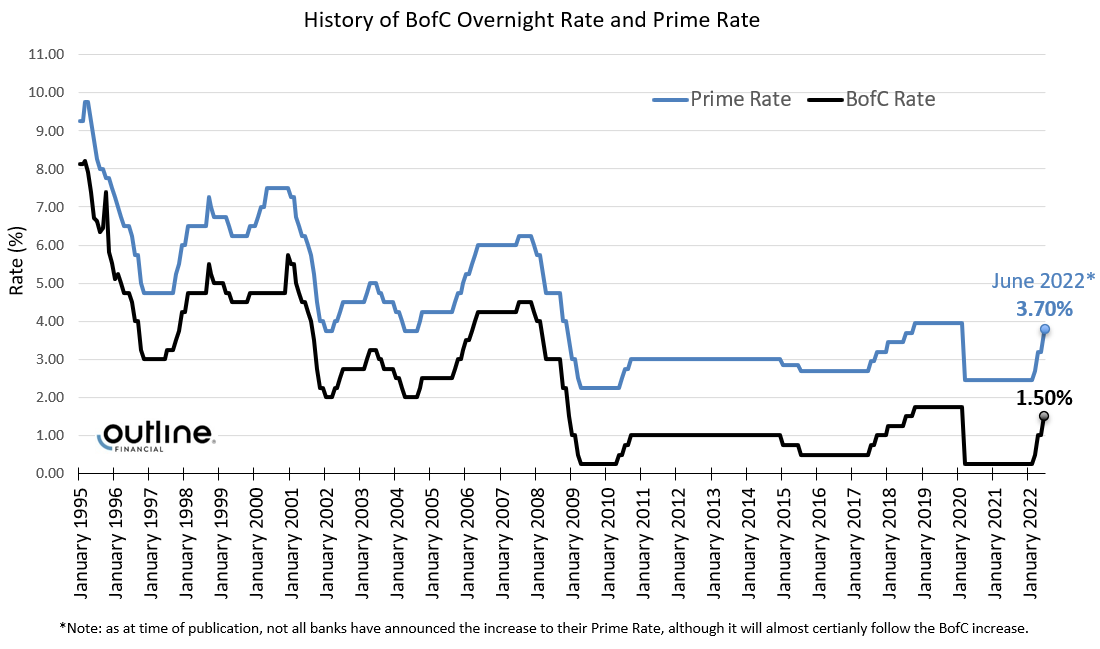

On June 1st, as widely expected, the Bank of Canada once again increased their overnight rate by 0.50% bringing it to 1.50%. Prime Lending Rate increased accordingly from 3.20% to 3.70% (TD Mortgage Prime moved from 3.35% to 3.85%).

Why did the Bank of Canada (BofC) increase their overnight rate?

In its statement accompanying the decision, the BofC said: “…CPI inflation reached 6.8% for the month of April – well above the Bank’s forecast – and will likely move even higher in the near term before beginning to ease…The Bank will use its monetary policy tools to return inflation to target and keep inflation expectations well anchored.”

“Canadian economic activity is strong and the economy is clearly operating in excess of demand…job vacancies are elevated, companies are reporting widespread labour shortages, and wage growth has been picking up and broadening across sectors. Housing market activity is moderating from exceptionally high levels.”

With the economy in excess demand, and inflation persisting well above target and expected to move higher in the near term, the Governing Council continues to judge that interest rates will need to rise further.”

What’s next?

The Bank of Canada has raised its overnight rate by 1.25% so far in 2022 (currently at 1.50%) and we anticipate an additional 1.50% of increases through the end of the year which we discuss in the below Mortgage Rates & Trends section. The next two Bank of Canada interest rate meetings are scheduled for July 13th and September 7th.

What does this mean for you?

While the Outline Financial team is on standby to discuss how these changes may impact your existing or potential mortgage, we have included a few scenarios below:

Scenario 1: You have a variable “non-adjustable” mortgage (VRM)

In this scenario your mortgage payment will remain the same, however, a higher proportion of each payment will go towards paying interest vs. principal. The net impact is an extended amortization (total amount of time to pay off your mortgage will be longer).

What can you do? As variable rates remain well below fixed rates, you could keep everything the same and continue with the same monthly payment. Alternatively, you could increase your mortgage payment to ensure you remain on pace with your current amortization schedule. For questions on your payment strategy, or to review potential pros/cons of converting your current VRM into a fixed mortgage, please reach out at any time.

Scenario 2: You have a variable “adjustable” mortgage (ARM).

In this scenario, your mortgage payment will automatically increase to ensure you keep pace with your current amortization schedule. If you would like to discuss future interest rate projections, or the potential pros/cons of converting your ARM into a fixed mortgage, please reach out at any time.

Scenario 3: You have a fixed-rate mortgage.

If you have a fixed-rate mortgage, there is no impact on your mortgage payment (or amortization) as you have received a guaranteed rate for the duration of your mortgage term. Only when your mortgage comes up for renewal, or if you sold and purchased a new home, would you potentially be impacted by higher rates.

Scenario 4: You are currently looking for a mortgage or pre-approval.

To be fixed or variable…that is the question! While this one topic could fill a book, there are a couple of key points that you will want to keep in mind if trying to decide between the two.

– Variable rate mortgages are directly impacted by the Bank of Canada as described in Scenario 1 and 2 above and will move up or down based on the BofC rate decisions. Variable rate mortgages are generally much more flexible than fixed rate mortgages in terms of exit penalties if you ever need to break your mortgage.

– 5-year fixed mortgage rates typically follow the Government of Canada 5-year Bond Yields which is the market’s view/prediction of where interest rates will be in the future. The bond yields actually started moving upward back in very early 2021 in anticipation of future Bank of Canada rate increase(s) in 2022 and beyond. Bond yields (and fixed rates) are currently at the highest levels we’ve seen since 2011 and already factor in a continued series of Bank of Canada rate increases between 2022 and 2023.

– “Mind the Gap ” – when deciding between fixed and variable it is important to analyze not only the difference in the current rates, but also the expectation of future Bank of Canada rate changes. For example, if the current fixed rate (a sure thing over the term of your mortgage) is 1.25% higher than the current variable rate option (subject to change over the term of your mortgage), will that initial 1.25% “GAP” or “initial rate savings” be sufficient to protect you from any future Bank of Canada rate increases? Every situation is unique and we have a number of tools that can help model out the expectations for your specific circumstances.

For a customized analysis of which rate or product option might be right for you, please contact a member of the Outline Team as we are always on standby to help.

w: www.outline.ca

e: hello@outline.ca