Great Mortgages. The Right Insurance. Expert Advice.

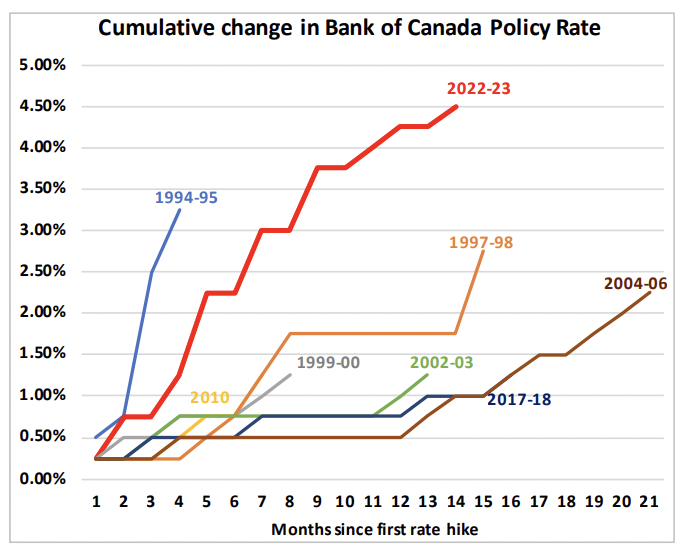

Bank of Canada adds to the steepest rate hike cycle in 40 years

The Bank of Canada surprised markets by hiking its policy rate by 25 basis points (0.25%) to 4.75% earlier this month. This latest increase adds to what is already the steepest cumulative rate hiking cycle in over 30 yea rs.

rs.

In the decision, the Bank pointed to a Canadian economy that remains “stronger than expected,” as well as inflation “for a broad range of goods and services coming in higher than expected.”

Markets interpreted the language to mean that at least one more 0.25% rate hike should be expected, predicting this could likely come in July.

The rate hikes to date have led to a dramatic slowdown in mortgage demand. Total mortgage debt outstanding grew by just $5.7 billion or just 0.3% in the first quarter of this year, relative to Q4 2022. That’s the lowest growth rate in the past 20 years.

But the reality is that economy is showing signs of cooling, and talks of further rate hikes may be premature. Just days after the June rate hike, we learned that the Canadian economy shed 17,000 jobs in May, including nearly 33,000 full-time positions. Outside of COVID-related public health measures (i.e., lockdowns), this was the largest decline in full-time employment in over 5 years. The unemployment rate also ticked up 0.2% to 5.2%.

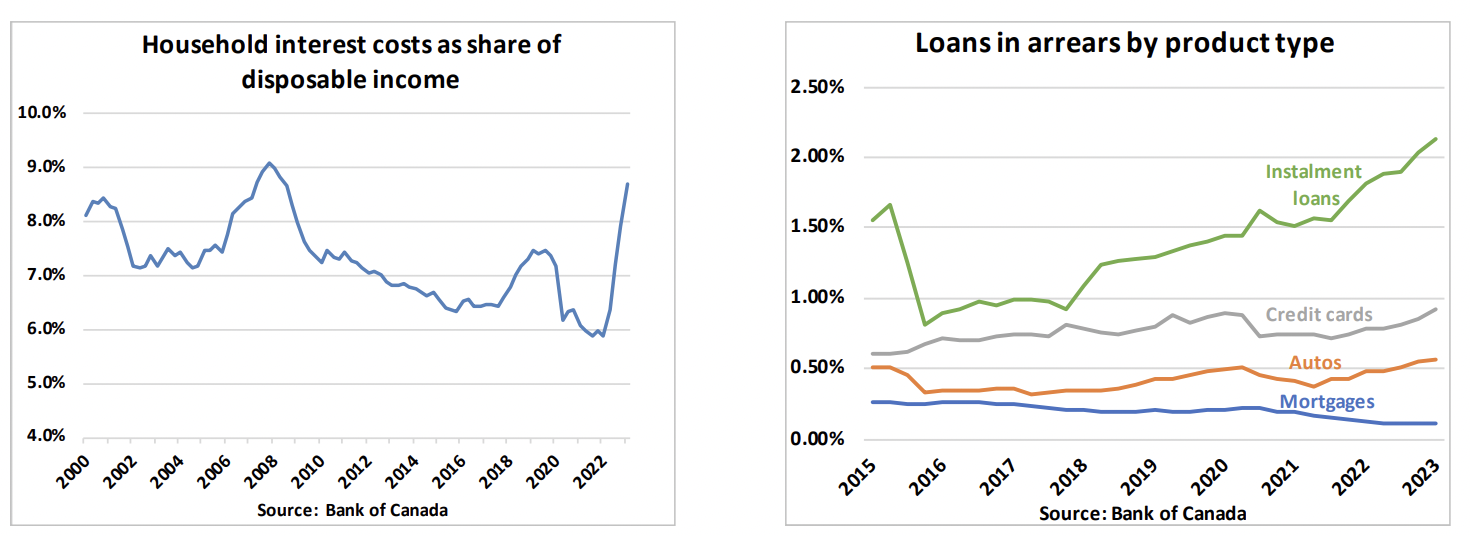

High rates are also weighing more heavily on consumers. Interest costs as a share of disposable income rose to the highest level since 2008 in the first quarter of 2023, according to Statistics Canada.

And we’re now seeing arrears across various non-mortgage consumer credit products like credit cards and autos rising to decade highs.

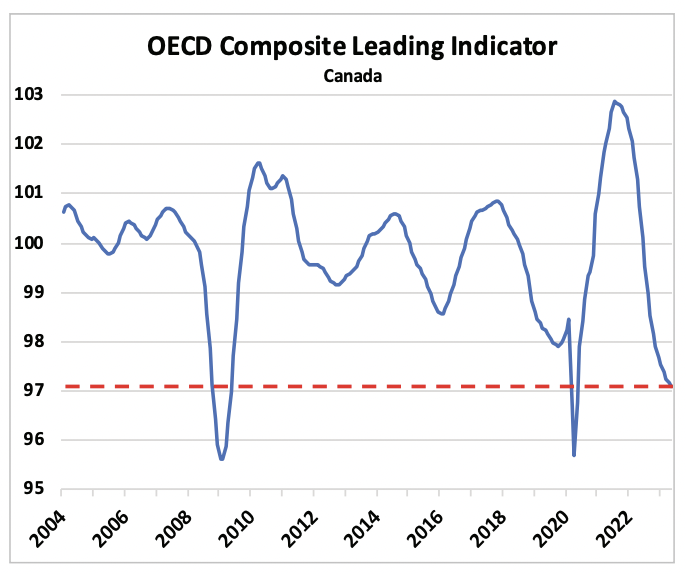

All of this points to a slowdown in consumer spending on deck. Already, leading indicators of Canadian economic activity, as measured by the OECD, remain at levels that historically have signalled recession.

While the Bank of Canada is focused on an overheating economy, my concern now is for an economic slowdown and likely recession later this year or early 2024. The Bank of Canada underestimated the stickiness of inflation in late 2021 and early 2022. Today I believe they are overestimating the resiliency of the Canadian economy in the face of the interest rate hikes to date.

Home sales and new listings rise in May

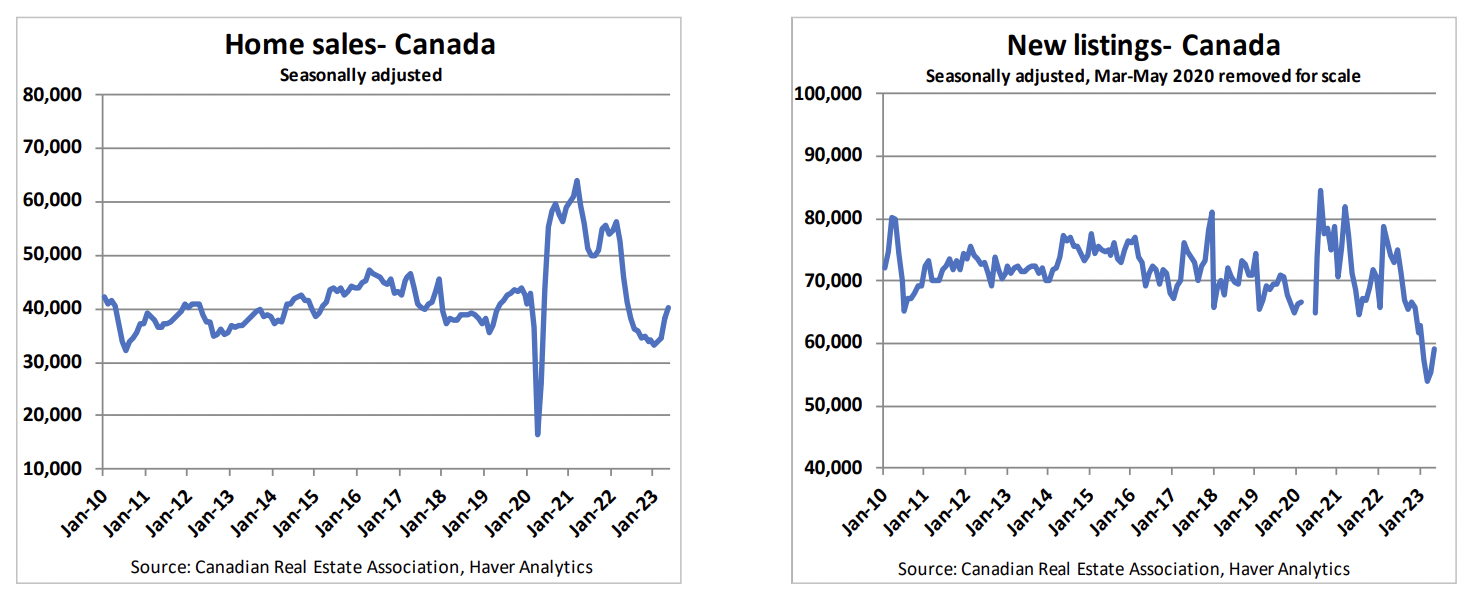

Seasonally adjusted home sales jumped 5.1% in May, bringing the cumulative increase off the January lows to 22%.

With the Bank of Canada’s latest rate hike pushing variable mortgage rates to fresh highs and with fixed rates closing in on their respective October 2022 highs, it’s likely we see a pullback in demand in the coming months.

But the real story is on the supply side. Seasonally adjusted new listings rose 6.8% on the month but remain roughly 13% below normal levels for the past decade.

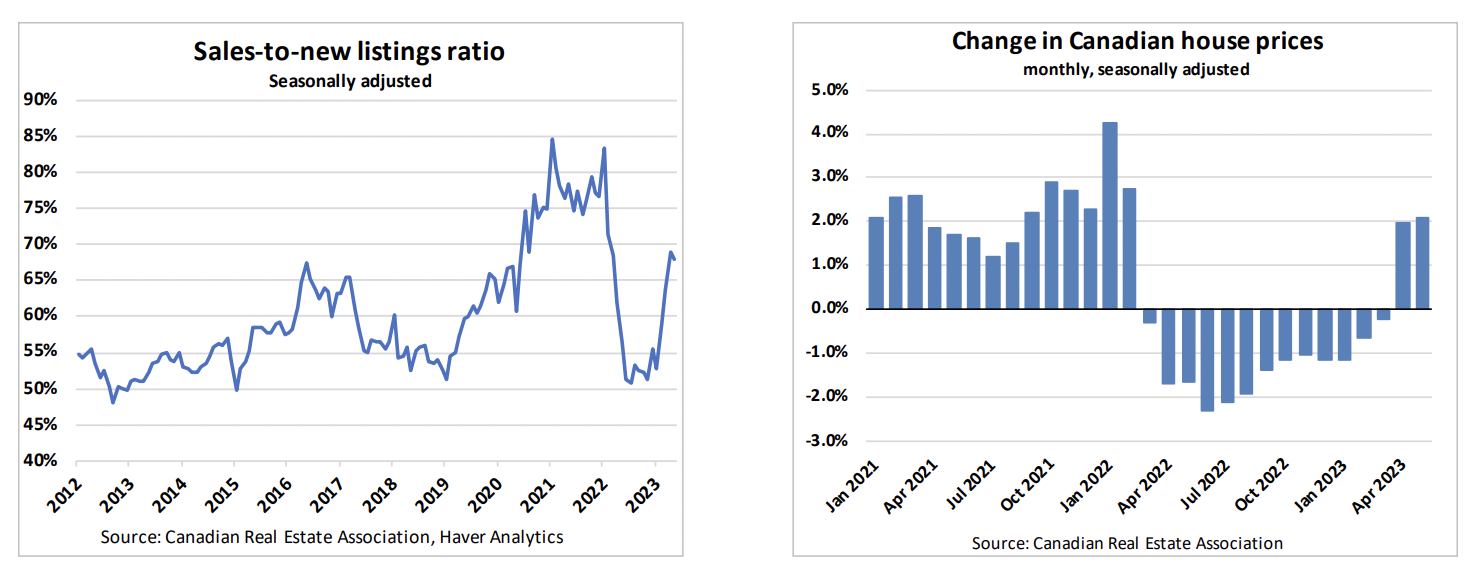

The sales-to-new listings ratio remains well above 60%, the typical threshold that delineates a strong seller’s market. That will likely change in the coming months if the trend of rising new listings and slowing sales plays out as expected.

With the resale market balance still very tight, house prices are back on the rise. We’ve now seen consecutive 2% monthly increases in the seasonally adjusted composite House Price Index.

While the latest housing data points to a continued recovery from the recent lows, a lot has changed in just the past few weeks. I expect the impact of the latest interest rate hike will have an immediate effect on the market, and we’ll likely see a slowdown in sales and a rise in inventory heading into the summer.

Looking long-term, as with all other previous cycles, this one will also end in time. Underlying long-term fundamentals like record population growth and structural undersupply will again reassert themselves.

Source: Mortgage Professionals Canada