Great Mortgages. The Right Insurance. Expert Advice.

2017 Mortgage Consumer Survey

Your Outline Financial Team.

Call or email at any time:

CMHC recently completed an online survey of 3,002 recent mortgage consumers, all prime household decision-makers who had undertaken a mortgage transaction in the past 12 months. Sixty-five percent had undergone a mortgage renewal, 15% had refinanced their mortgage, and 20% had purchased a home with mortgage financing (11% First-Time Buyers and 9% Repeat Buyers). CMHC has conducted this survey since 1999. It is the largest and most comprehensive survey of its kind in Canada.

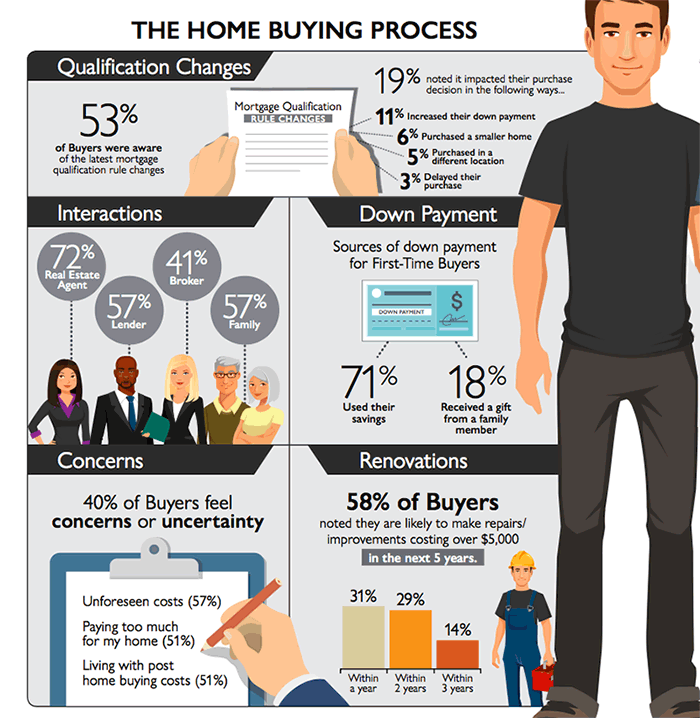

The Home Buying Process

- Sixty-four percent (64%) of First-Time Buyers indicated they were renting before purchasing, and 34% lived with family.

- Wanting to buy their first home (37%) and feeling financially ready (31%) were the most important reasons First-Time Buyers gave for purchasing a home in the past year.

- Low interest rates (33%) was the most important reason for Repeat Buyers to purchase a home in the past year.

- Fifty-three percent (53%) of buyers were aware of the latest mortgage qualification changes, and 19% noted that it impacted their purchase decision. For example, 11% of buyers said they increased their down payment, 6% purchased a smaller home, 5% purchased in a different location, and 3% delayed their purchase.

- Buyers interact with a wide variety of people, and are most likely to consult a real estate agent (72%), or look to a family member or mortgage lender for advice (both at 57%). Forty-one percent (41%) reported interacting with a mortgage broker. Of all interactions, real estate agents were noted as most valuable.

- Seventy-one percent (71%) of First-Time Buyers accessed savings for their down payment, while 18% received a gift from a family member.

Click to Read More -> [CMHC 2017 Mortgage Consumer Survey]