Great Mortgages. The Right Insurance. Expert Advice.

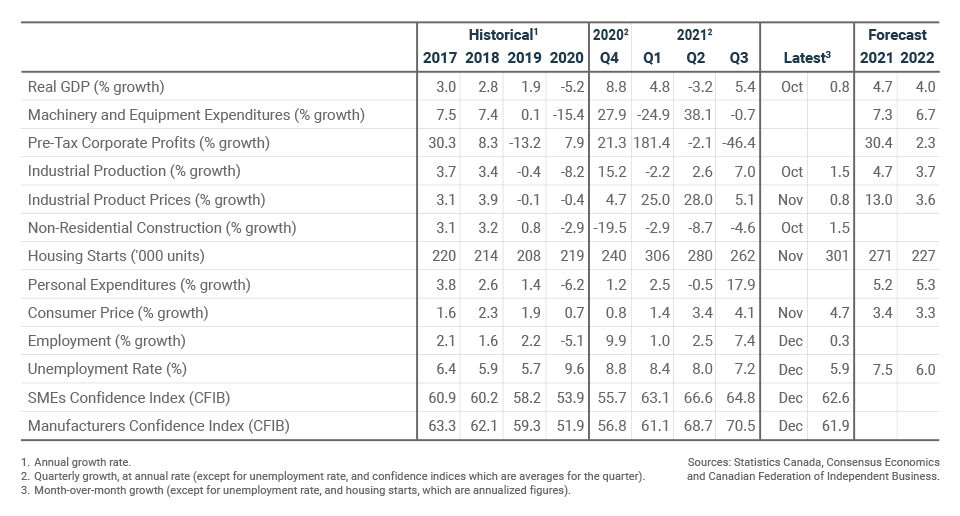

Key Economic Indicators

BDC Economic Letter – January 2022

The Business Development Bank of Canada (BDC) Source article can be found [HERE]

No rate hike in January

While the surge in new daily cases in Canada and the introduction of restrictive measures to deal with them will slow the recovery early in the new year, the Bank of Canada is expected to announce its first rate increase by mid-year. The surging inflation of recent months continues to spread widely through the economy and the new Omicron variant may even worsen the factors causing these price increases. The Bank will likely maintain the status quo at its January 26 meeting as there is still a lot of uncertainty surrounding the impact of this new wave.

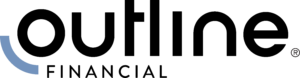

The loonie rebounds after a slight decline

The rebound in oil prices since late December continues to support the Canadian dollar around US$0.78 after the slight pullback brought on by the new wave of infection in the country. The Federal Reserve’s more aggressive tone on tightening monetary policy and the economic uncertainty resulting from the new lockdown measures implemented in Canada are the main reasons why the loonie has not appreciated further. The loonie should remain below US$0.80 in the short term.

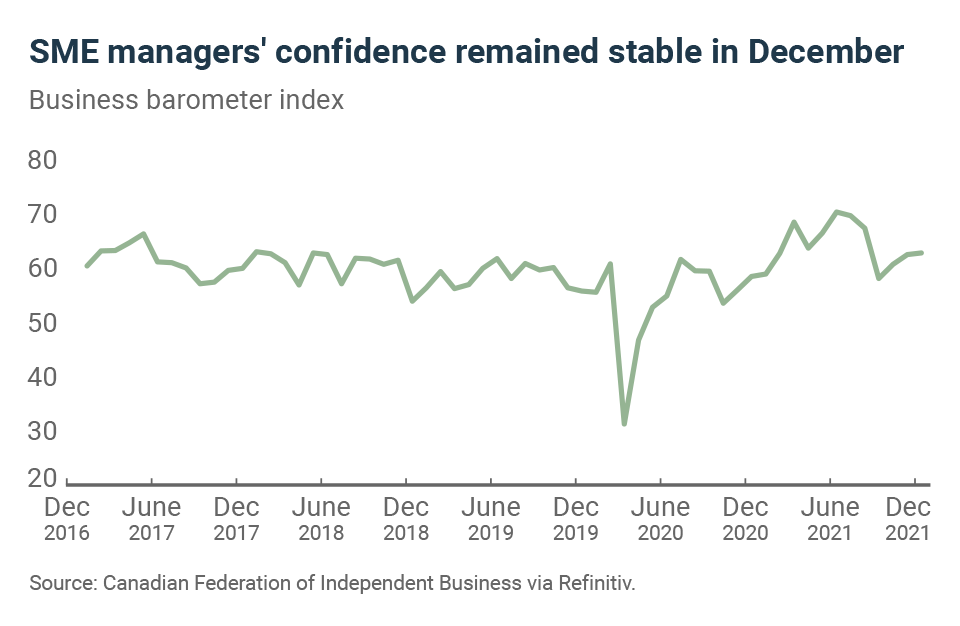

SME long-term confidence remains stable

The Canadian Federation of Independent Business’ Business Barometer Long-Term Index held near its November level in December, reaching 62.6. The long-term index captures the expectations of business leaders over a 12-month horizon, while the short-term index captures expectations over a three-month horizon. Obviously, the importance of the new wave of COVID-19 infection caused by Omicron was reflected in the short-term confidence index, which dropped nearly five points last month. The index was still below 50, which means that more companies are expecting weaker performance in the first quarter of 2022.