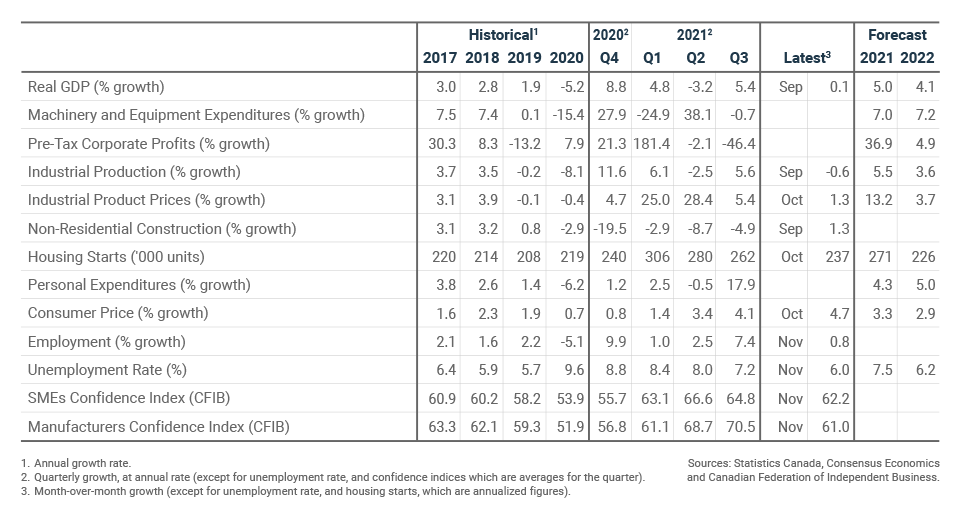

Great Mortgages. The Right Insurance. Expert Advice.

Key Economic Indicators

BDC Economic Letter – December 2021

The Business Development Bank of Canada (BDC) Source article can be found [HERE]

Bank of Canada to remain cautious

In October, the Bank of Canada announced the end of quantitative easing and suggested that the first interest rate hike could come as early as April 2022. The latest announcement on December 8 was not substantially different from the previous one. The Bank will likely be more cautious in tightening monetary policy as it expresses concern about mortgage debt in the country in the face of rising rates.

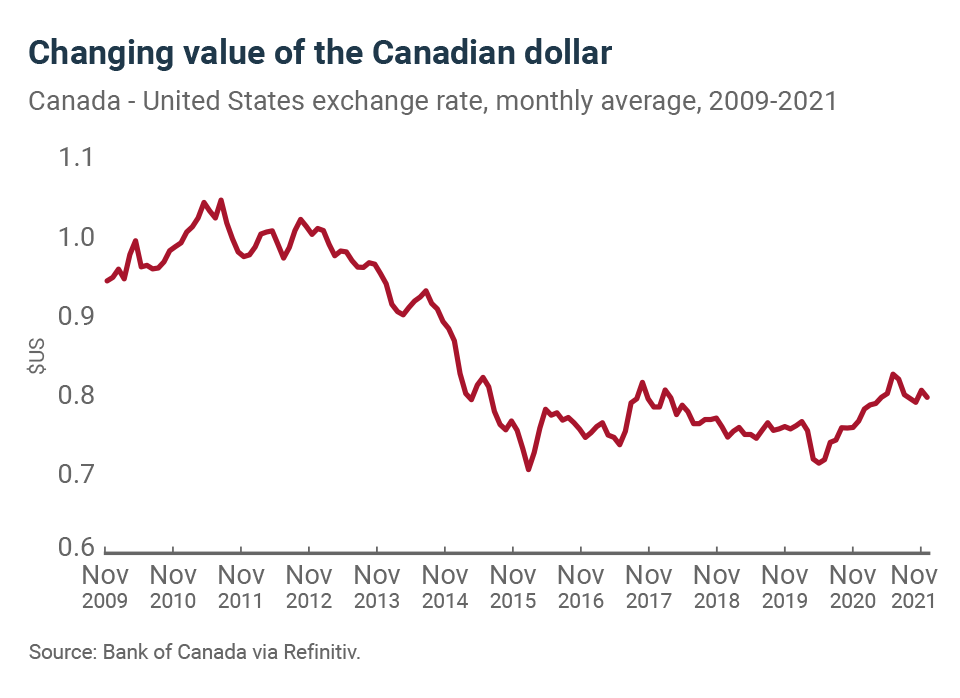

The Canadian dollar fell below US$0.78

The Canadian currency has hovered around US$0.79 in recent weeks, down from its 2021 annual average. More recently, in early December, the loonie slipped under US$0.78. Although the drop in oil prices is not unrelated to this depreciation, the uncertainty brought up by the Omicron variant in the markets has also contributed to the dollar’s decline against its American counterpart.

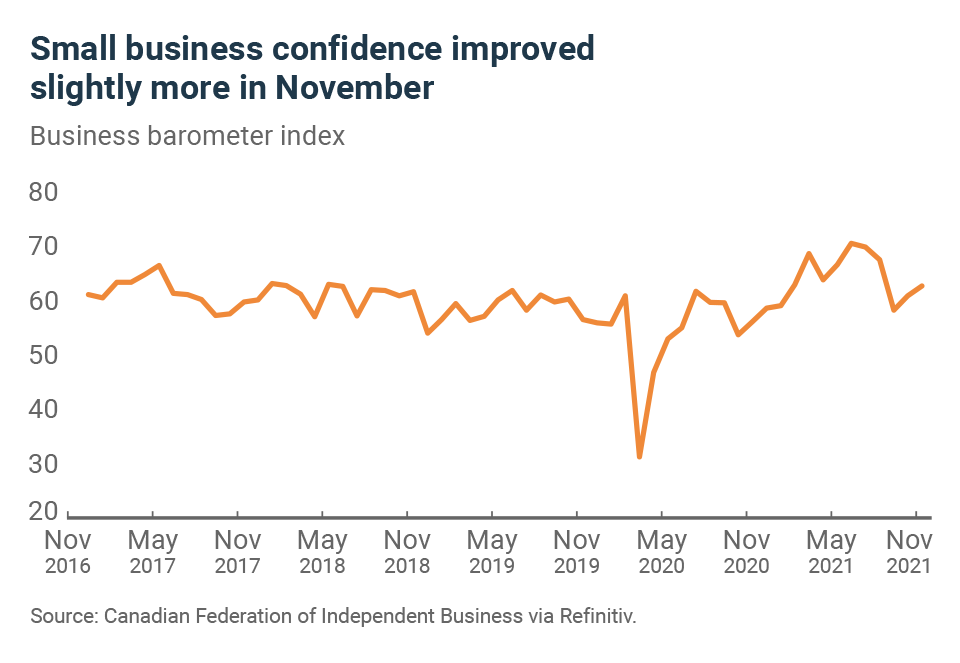

Business confidence is slowly recovering

In November, the CFIB’s business confidence index rose a few more points. Since falling sharply in September, the index has yet to return to the high levels experienced during the summer and stood at 62.2 in November. An indicator above 50 indicates that entrepreneurs expect the business environment to improve over the next 12 months. However, the short-term indicator (next three months), despite increasing to 49.8, shows that business owners see the reopenings as positive, although they are aware that challenges remain. In short, business owners are realistic about the economic challenges of the next few months but believe that the economy will recover in the longer term.