Great Mortgages. The Right Insurance. Expert Advice.

Canadian Economy at a Glance

BDC Economic Letter – January 2022

The Business Development Bank of Canada (BDC) Source article can be found [HERE]

Backtracking: Omicron slows the Canadian recovery

Increasing restrictions in Canada and elsewhere around the world to combat the Omicron variant will hamper the economic recovery as we enter the new year. However, we expect the Canadian economy to continue to show resilience.

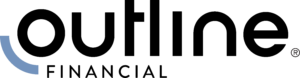

The risk lies almost entirely with high-contact industries such as accommodation, food service and the arts and culture sector. Many Canadians have already cancelled trips and events even without being forced to do so. Each new wave increases an imbalance in recovery among sectors.

The fourth quarter will have brought some relief

Real GDP grew by 0.8% in October compared to 0.2% in September as pandemic health measures continued to be withdrawn across the country.

According to preliminary data from Statistics Canada, GDP growth came in at 0.3% in November, confirming strengthening growth in the last quarter of 2021.

Food services and accommodation were however less busy than they were this summer (-0.5% from September).

These sectors, which had been slower to rebound, experienced lower growth in October, reaching 87% and 82% of their pre-crisis activity levels, respectively. The fortunes of these industries are obviously expected to suffer another setback in coming months due to Omicron.

The manufacturing sector did well in October, despite ongoing supply problems. The sector grew by 1.8% compared to September, thanks to the reopening of automobile and parts plants (+19.1%), among other bright spots.

Job gains in December despite Omicron

Employment increased by 54,700 in December despite the addition of health restrictions in Ontario and Quebec. The economic recovery of recent months has more than made up for the historic job losses at the height of the COVID crisis. To date, there are still 240 500 more jobs than in February 2020.

However, these figures are from mid-December and therefore do not take into account all of the new restrictive measures. January data may therefore show the first decline in employment since May 2021. We expect those job losses to be concentrated in Quebec and Ontario, the first provinces to reinstate restrictions.

Inflation continues to rise

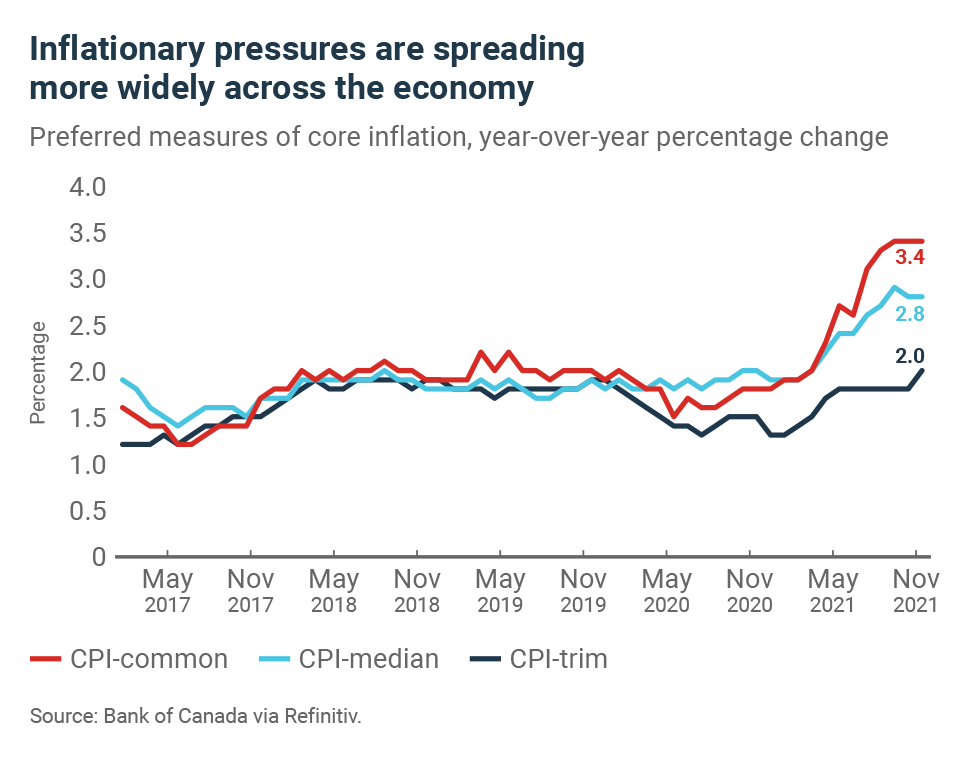

The Consumer Price Index rose 4.7% in Canada in November compared to 2020. While this pace is similar to October, it marks a 30-year high.

More importantly, one measure of core inflation, CPI-common, the Bank of Canada’s preferred benchmark, rose to 2.0%. This suggests inflationary pressures are spreading further through the economy. The situation could force the bank to raise rates more quickly than previously forecast despite an economic slowdown brought on by Omicron.

After a recent review, the Bank of Canada’s mandate was reconfirmed. New wording regarding full employment simply puts on paper what the bank’s executive committee had already been doing.

Bottom Line

- The next few weeks will be difficult as restrictive measures remain in place. This step backwards will once again test the resilience of the industries most affected by the pandemic.

- While the economic recovery may be slower in the first quarter of 2021, growth will quickly take hold again once this new wave is behind us.

- Interest rates may begin to rise soon despite the weight of the new variant on the economy. Inflation continues to spread widely through the economy and Omicron may even exacerbate the factors behind these price increases.